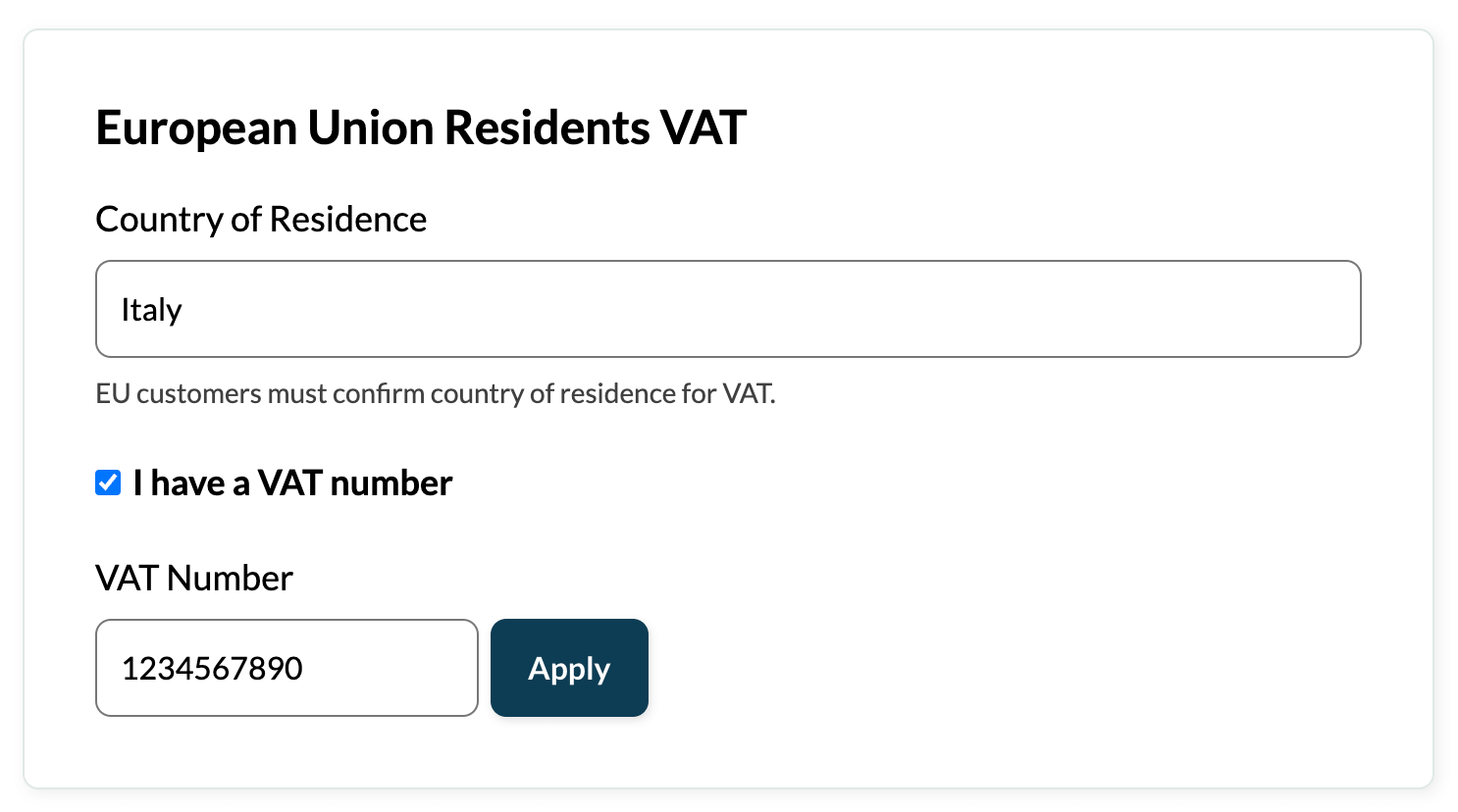

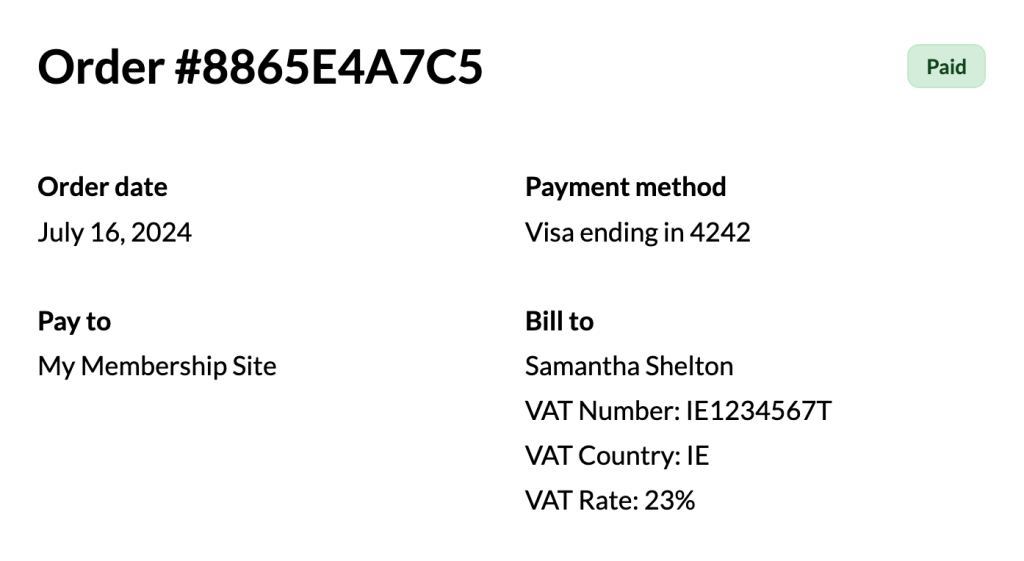

This plugin adds a new section on the Membership Checkout form titled “European Union Residents VAT”. The customer can select their EU country of residence from a drop-down box or enter their VAT number to avoid the tax. The entered VAT number is validated using the SOAP service provided through the European Commission [docs].

VAT rates are automatically calculated based on the constant rates defined in the plugin. The rates in our plugin are those currently listed by the European Commission [docs].

Installation

You must have the Paid Memberships Pro plugin installed and activated with a valid license type to use this Add On.

- Navigate to Memberships > Add Ons in the WordPress admin.

- Locate the Add On and click Install Now.

- To install this plugin manually, download the .zip file above, then upload the compressed directory via the Plugins > Add New > Upload Plugin screen in the WordPress admin.

- Activate the plugin through the Plugins screen in the WordPress admin.

Add your “Seller Country” to the settings field on the Memberships > Settings > Payment Gateway screen in the WordPress admin.

Automatically Detect the User’s Location

We’ve recently added GeoIP support to this add on to automatically detect the user’s country. You must install and activate the GeoIP Detect plugin in order to take advantage of this integration.

Action and Filter Hooks

apply_filters('pmpro_vat_by_country', $pmpro_vat_by_country)

- Filters the VAT tax rate for each countries

$pmpro_vat_by_country– array mapping country abbreviations to their respective tax rates

apply_filters('pmpro_european_union', $pmpro_european_union)

- Filters the list of countries in the European Union

$pmpro_european_union– array mapping country abbreviations to their full country names

apply_filters( 'pmprovat_hide_vat_if_same_country', true )

- Filters whether the VAT field should be hidden if the buyer’s country matches the sellers

apply_filters('pmprovat_skip_validation', false)

- Filters whether PMPro should skip validating VAT numbers that are entered

apply_filters('pmprovat_custom_vat_number_validate', $result)

- Filters the result of a VAT number validation check

apply_filters( 'pmprovat_calculated_taxes', $tax, $values, $vat_rate, $vat_number, $eucountry, $bstate )

- Filters the amount of VAT tax that is added to an order

$tax– a float that is being added to the order$values– array passed to thepmpro_tax()function$vat_rate– float being charged- string

$vat_numberthat the user entered - string

$eu_countrythat the buyer is from - string

$bstatethat the buyer is from

apply_filters( 'pmprovat_rounding', 2 )

- Filters the number of decimals to round VAT tax amounts to

- Parameter – integer, default

2

Screenshots

.

This is a Standard Add On.

Standard membership includes all Standard Add Ons, unlimited premium support, automatic updates, and additional benefits.